June 12th, 2023 | Posted in Investing

Are Bonds No Longer a Good Volatility Hedge?

Most readers are aware of the ongoing volatility in the stock market. Generally speaking, selling pressure in the stock market should mean that bonds – and in particular U.S. Treasuries – are holding their own and maybe even zigging where stocks are zagging.

But that has not been the case.

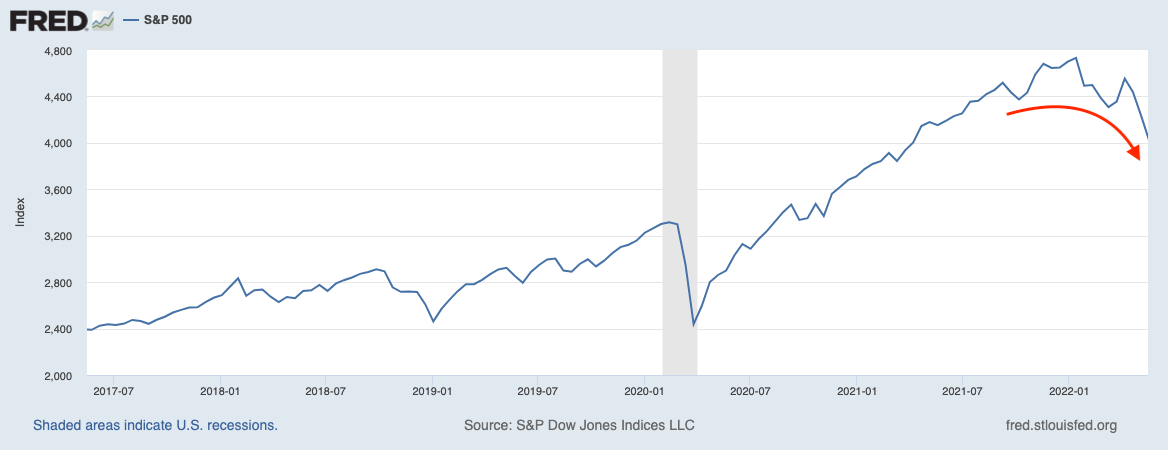

Through the first quarter of 2022, the S&P 500 index was down roughly -13% while the Bloomberg U.S. Aggregate bond index—which is comprised mostly of U.S. Treasuries, mortgage-backed securities (the good kind), and investment-grade corporate bonds—had declined by -10%. Investors who rely on bonds and fixed income securities as a hedge against stock market volatility were understandably disappointed, and perhaps even a bit confused. 1

Does this mean bonds are no longer a good volatility hedge for the equity markets? The data in Q1 seems to suggest a breakdown. The highly correlated decline of stocks and bonds was the biggest recorded since 1976, and the only other instance when the S&P 500 and the Bloomberg U.S. Aggregate bond index both declined for the year was 1994, with stocks falling by -1.5% and bonds retreating -2.9%.

Positioning your investments for a volatile market.

“Don’t put all your eggs in one basket.” It’s a classic proverb, and for good reasons. Diversifying your portfolio is one the most basic pieces of investing advice—but unfortunately, it’s also advice that too many investors ignore.

Zacks Advantage would like to help you ensure that your investments are properly diversified so that you can avoid the risks of over-concentration in any particular asset class. That’s why we’re offering our free guide, Is Your Investment Portfolio Actually Well-Diversified?

Act now to get the basics of diversification, including:

- Why the average investor’s returns lag behind almost every investment category

- 4 myths of a diversified portfolio

- How to create a truly well-diversified portfolio

Learn more with our free guide, Is Your Investment Portfolio Actually Well-Diversified?.2

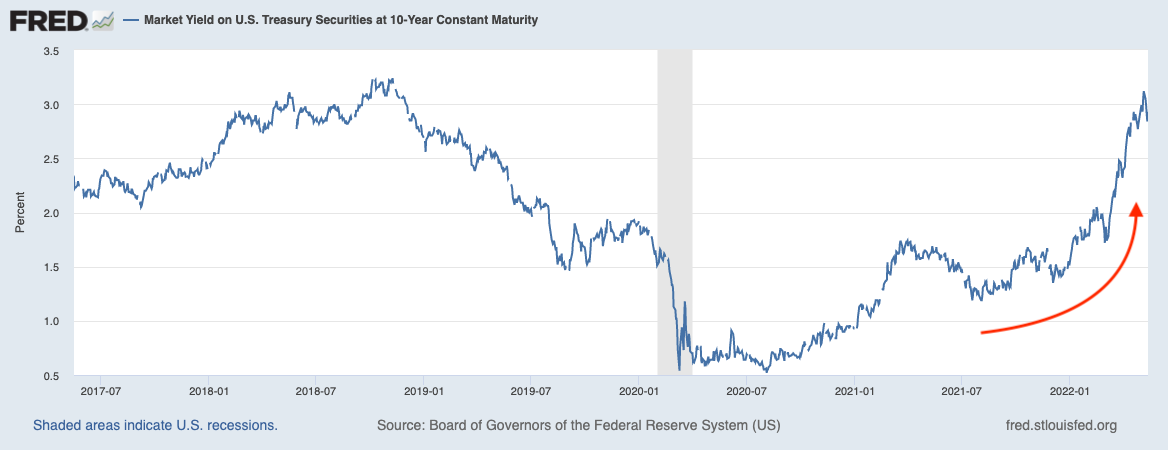

As readers can see in the two charts below, the declines have not only been simultaneous but also sharp and swift. The first chart shows the yield on the 10-year U.S. Treasury bond, and readers should remember that as bond yields rise, prices fall. The second chart shows the S&P 500 falling into a correction just as the 10-year yield spikes.

While this trend appears problematic at first glance, we do not think investors should read too much into these short-term moves. Stock market volatility and corrections, particularly when they are accompanied by a slew of negative headlines covering inflation, rising interest rates, a war, and lockdowns in China, can cause swings in investor sentiment that drive sharp adjustments in the market.

We may be seeing some of this corrective activity in the bond market as well, as expectations for higher- and longer-than-expected inflation has some investors hesitating to buy bonds – given that rising inflation can adversely impact the purchasing power of bonds’ coupon payments. Evidence of this investor reluctance can be seen in bond flows, which are generally positive but have seen three periods in recent years of negative flows. The first was in late 2018 when the Federal Reserve began discussing higher rates, the second was in the middle of lockdowns during the pandemic, with the third being now.

At worst, investors are shifting portfolio asset allocations away from bonds in response to short-term volatility in the markets, which can ultimately go against an investor’s longer-term goals and objectives. Whether a bond allocation’s primary purpose in a portfolio is to diversify away from equity market volatility or provide income for the investor over time, we would caution against allowing the first quarter’s correlated decline to make wholesale changes to an asset allocation. Short-term moves should not influence long-term strategies.

Bottom Line for Investors

Zacks Advantage has been actively managing our fixed income allocations over the last two quarters. We have shifted to a shorter duration in the portfolio in anticipation of policy normalization by the Federal Reserve, which paid off during the sharp selloff in Q1. In our view, the Russian invasion of Ukraine dented bondholders’ appetite for risk, widening corporate credit spreads as investors preferred lower duration bonds. We remain underweight duration.

Our tactical strategy shifts are not the same thing as eliminating fixed income in portfolios altogether, however, which we believe will continue to serve an important purpose for investors who are seeking additional diversification against equity market volatility while also providing a source of income. In other words, it is not the end of an era for bonds, just a correction and a shifting market environment that we believe requires active management.

Most investors can get where they need to go over the long term by owning a diversified portfolio of stocks and/or ETFs. In fact, “diversify your portfolio” is one the most basic pieces of investing advice. Sadly, in our experience many investors still put all (or most) of their eggs in one basket.

At Zacks Advantage, we strive to help every investor properly allocate their assets. In fact, we’ve put together a helpful guide to help you understand the basics of portfolio diversification, including:

- Why the average investor’s returns lag behind almost every investment category

- 4 myths of a diversified portfolio

- How to create a truly well-diversified portfolio

Get our free guide, Is Your Investment Portfolio Actually Well-Diversified?,5 to learn how to create a truly diversified portfolio.

1 Wall Street Journal. May 3, 2022.

2Zacks Investment Management may amend or rescind the A Better Way Forward: Actively Managing Passive Index Funds guide offer for any reason and at Zacks Investment Management’s discretion.

3Fred Economic Data. May 13, 2022.

4Fred Economic Data. May 16, 2022.

5Zacks Investment Management may amend or rescind the A Better Way Forward: Actively Managing Passive Index Funds guide offer for any reason and at Zacks Investment Management’s discretion.

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. All material in presented on this page is for informational purposes only and no recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Nothing herein constitutes investment, legal, accounting or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.