Can Fed Raise Rates Without Triggering a Recession?

May 13th, 2022 | Posted in Investing

Can the Federal Reserve Raise Rates Without Triggering a Recession?

The Federal Reserve is firmly on the path of tightening monetary policy in 2022. The question is whether they get it right.

At the Federal Open Market Committee (FOMC) meeting next month, market-watchers expect the Fed to raise the benchmark fed funds rate by 50 basis points, while also detailing plans for how they will shrink their $9 trillion balance sheet. Additional 50 basis point increases are expected later in the year.

The Fed’s overarching objective is to get inflation under control, and their means of pursuing this goal is to tighten financial conditions in hopes they can temper demand in the economy. But this goal seems largely elusive in the short- to medium-term—inflation today is largely a supply-side issue, stemming from strong consumer demand bumping up against labor shortages and snarled supply chains that have been further complicated by China’s new Covid-19 outbreak and the war in Ukraine. A 50-basis point increase will not change this economic reality.1

Are Robo Advisors the Next Generation For Investment Management?

Robo advisors have made a splash by helping to streamline the investing process and possibly saving investors money. But can they replace the active management and personal attention of a traditional wealth manager? Our free Revolutionize Your Retirement guide takes a look at these important issues and more, providing our insights that may be able to help you make better investing choices. You’ll get our thoughts on:

- The Impact of Fees on Investments

- Technological Advantages including Rebalancing and Tax Loss Harvesting

- Combining Robo Technology with Active Management

Download your copy of Revolutionize Your Retirement.2

As a result, the Federal Reserve has been emboldened to raise rates relatively quickly. In Chairman Jerome Powell’s words, “we’re going to be raising rates and getting expeditiously to levels that are more neutral, and then that is actually tightening policy if that turns out to be appropriate, once we get there,” Mr. Powell said.

To translate, the Fed wants to get interest rates to “neutral” quickly, which would be a level that arguably does not boost the economy but does not hinder it either. While the ‘neutral rate’ sounds like just what the U.S. economy today needs, there’s a problem: no one knows what it is. Throughout history, the Fed has only been able to determine the neutral rate in retrospect, and they have usually been wrong.

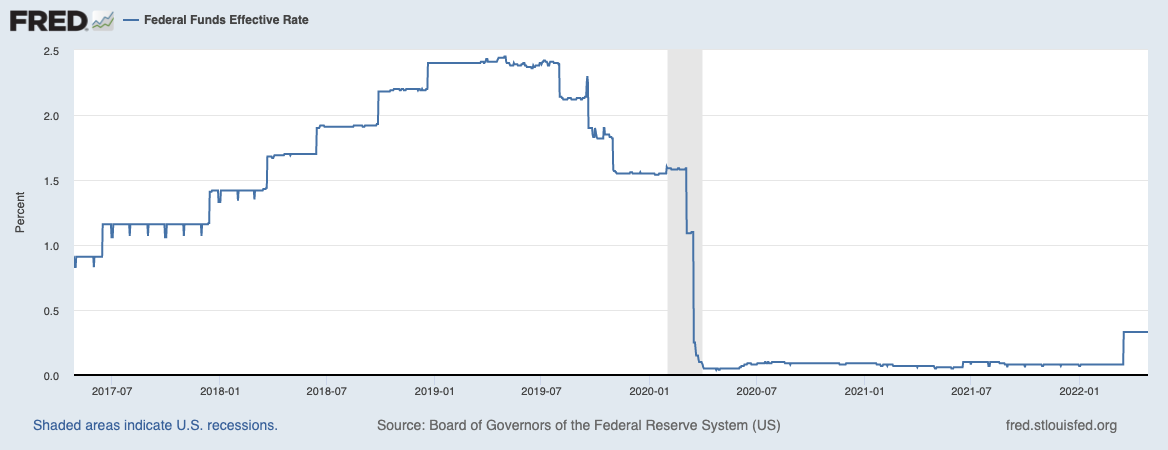

Cooling demand means getting interest rates to a level where households and businesses have more incentive to save than to borrow. That means the real neutral rate, adjusted for inflation, must at least be positive. When inflation is running hot, as it is now, it also means nominal rates must end up at a higher level than where inflation settles. Fed officials still seem to agree that inflation will eventually settle back down below 3%, which could necessitate raising rates perhaps up to 4% to slow the economy. As readers can see on the chart of the fed funds rate below, the Fed has a long way to go if this winds up being the case:

The current thinking is that the neutral rate is around 2.25% or 2.5%, and it seems increasingly likely the Fed wants to get there this year. From the market’s perspective, it’s not necessarily the rising interest rates that can create consternation, but rather the uncertainty over the path of rate increases.

Going back 50 years, there have been nine periods when the Fed entered a cycle of raising the benchmark fed funds rate, and stocks did well in all but one of them. In fact, the S&P 500’s average annualized returns during the tightening cycles were a stout +11.8%.4 This data point does not tell us stocks will go up during the current tightening cycle, but it does provide a pretty clear indication that stocks have not responded adversely to rising rates in the past.

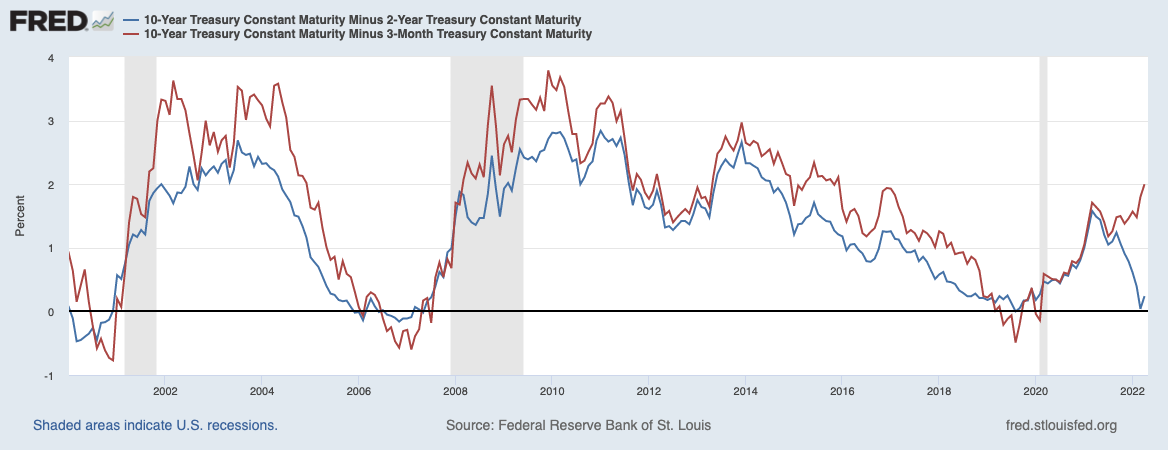

Changes in interest rates and interest rate expectations have resulted in an inverted yield curve, at least when comparing the 10-year U.S. Treasury bond to the 2-year Treasury bond (blue line in the chart below). Yield curves can be measured using interest rates across a wide range of maturities, however, and not all of them are signaling possible recession. The Fed’s preferred gauge for the yield curve, which compares the yield on the 3-month Treasury note to the 2- or 10-year yields, is not inverted and steepened in Q1 (red line). Many people miss this key point.

Based on the preferred gauge of the yield curve, the Fed has some wiggle room yet to raise rates. Whether they go too far too fast however remains to be seen.

Bottom Line for Investors

The Fed’s path of monetary tightening will likely be the most-watched economic fundamental in 2022, but in our view, it does not present a near-term concern for investors. Recessions happen after the Fed’s last rate hike, not their first one. Stocks and the economy can do well even as the Fed is attempting to move interest rates to the neutral rate, and 2022 is a year where both economic expansion and rate increases can happen alongside each other.

Today, innovative technology is changing the investment landscape quickly, including making investing for retirement potentially less complicated and more effective. Zacks Advantage is at the forefront of these developments with innovative investment solutions—including retirement investment solutions—using new financial technologies. Our actively managed robo advisor:

- Invests exclusively with ETFs

- Uses technology to recommend the appropriate mix of equities and bond ETFs to help achieve your investing goal and specific risk tolerance.

- Lowers fees and expenses

Our free Revolutionize Your Retirement guide6 provides investing insight that can help you determine whether technology-enhanced investing is right for you.

1 Wall Street Journal. April 24, 2022.

2Zacks Investment Management may amend or rescind the Revolutionize Your Retirement guide offer for any reason and at Zacks Investment Management’s discretion.

3Fred Economic Data. April 26, 2022.

5Fred Economic Data. April 29, 2022.

6 Zacks Investment Management may amend or rescind the Revolutionize Your Retirement guide offer for any reason and at Zacks Investment Management’s discretion.

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. All material in presented on this page is for informational purposes only and no recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Nothing herein constitutes investment, legal, accounting or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.