Higher Interest Rates Help Some Companies, Hurt Others

October 13th, 2023 | Posted in InvestingAre Higher Interest Rates Hurting Companies?

Most readers and investors are aware that in the aftermath of the 2008 Global Financial Crisis, the Federal Reserve lowered interest rates to the zero bound, drastically reducing the cost of capital. Interest rates started to tick back up – slowly – in the late 2010s, but then the pandemic happened and the Fed pulled interest rates right back to some of their lowest levels in history.

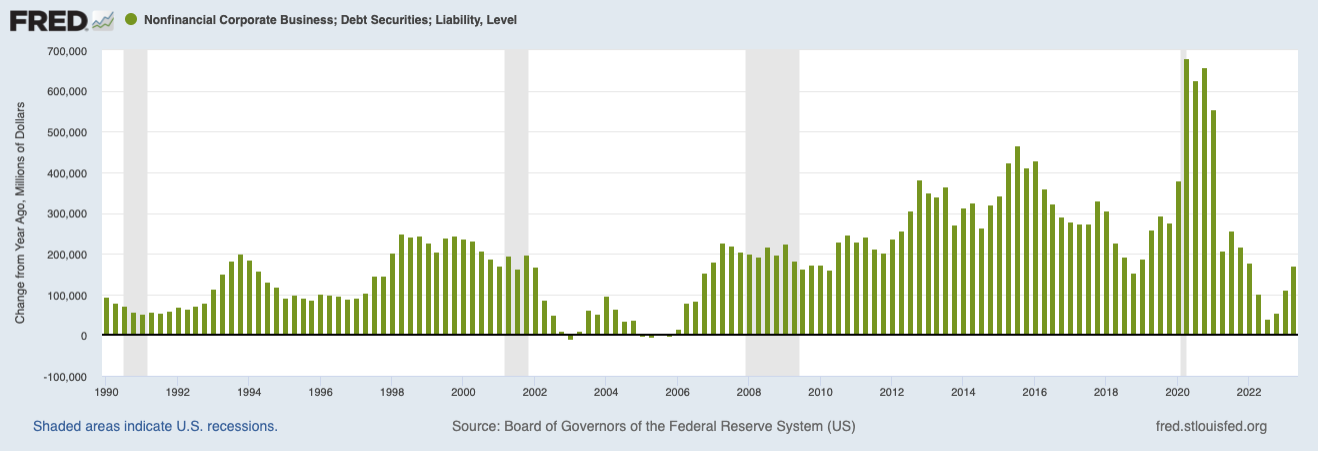

During the era of low-interest rates, corporations did what you might expect them to – they borrowed heavily. As seen in the chart below, corporate bond issuance followed the Fed’s path on interest rates closely. The level of debt securities on corporate books kept climbing in the years following the Global Financial Crisis as interest rates fell, then they scaled lower as the Fed started tightening policy in the late 2010s. When the pandemic happened and interest rates fell, borrowing surged again.

Corporate Debt Securities, Change from a Year Ago (Millions of Dollars)

Are Your Investments Really as Diversified as They Should Be?

“Don’t put all your eggs in one basket.” It’s a classic proverb, and for good reasons. Diversifying your portfolio is one the most basic pieces of investing advice—but unfortunately, it’s also advice that too many investors ignore.

Zacks Advantage would like to help you ensure that your investments are properly diversified so that you can avoid the risks of over-concentration in any particular asset class. That’s why we’re offering our free guide, Is Your Investment Portfolio Actually Well-Diversified? 2

Act now to get the basics of diversification, including:

- Why the average investor’s returns lag behind almost every investment category

- 4 myths of a diversified portfolio

- How to create a truly well-diversified portfolio

Learn more with our free guide, Is Your Investment Portfolio Actually Well-Diversified?

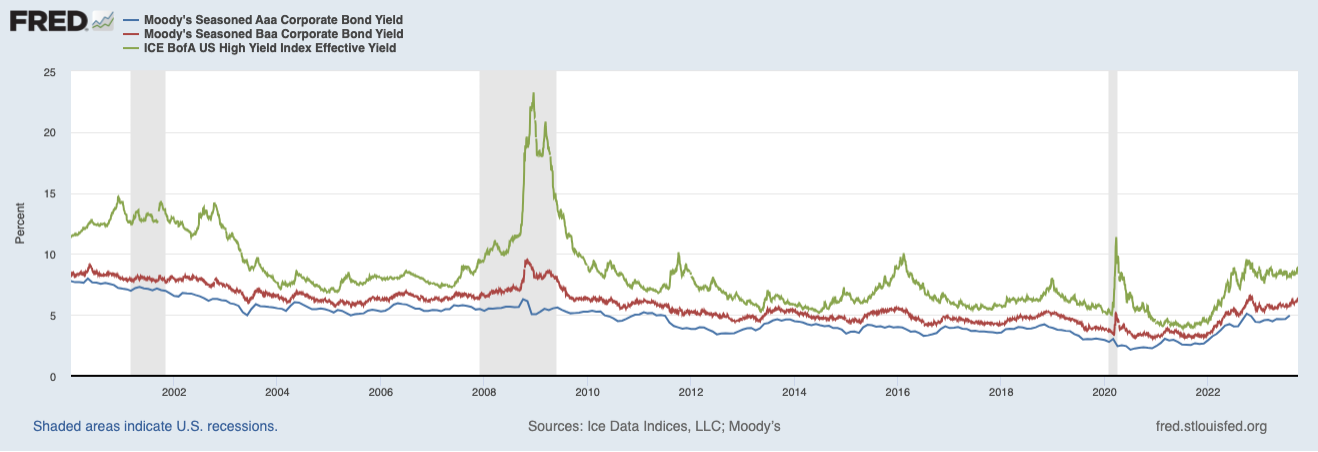

The setup here is important because corporations across the credit spectrum ultimately benefited from the long stretch of low interest rates. High-quality (AAA) borrowers like Apple and Microsoft were able to issue long-term bonds at low rates, locking in cheap financing even if rates moved higher (which they of course are now). Companies with less favorable credit ratings (the green and red lines in the chart below) were also able to borrow at low rates, though many were not able to lock in low rates for long-term debt and some chose to borrow using floating-rate bank loans.

Now that interest rates are rising, the impact on these two categories of corporate borrowers – high quality and low quality – is diverging.

For high-quality borrowers, higher rates may be helping – not hurting – their bottom lines. Since a good portion of balance sheet debt for high-quality borrowers is long-term, higher rates don’t really affect borrowing costs all that much right now. To understand why, think about the impact of higher rates on your existing mortgage payment (there isn’t any impact). At the same time, corporations are earning more on the idle cash sitting on their balance sheets, since interest rates are higher. Net-net, high-quality companies are doing better in this era of higher interest rates, not worse.

Microsoft offers an example of how this works. They were big debt issuers when rates were ultra-low, and now they have fixed borrowing costs. The interest Microsoft paid on their debt in Q2 2022 was $492 million, which is the same figure they paid in Q2 2023. However, because Microsoft has more cash and short-term investments than debt, the interest they earned on that money went up as debt interest payments stayed level. The annualized rate of return on Microsoft’s cash and short-term investments went from 2.1% to 3.3%, allowing it to earn $905 million in interest last quarter – a significant jump from the $552 million in interest it earned just a year ago.

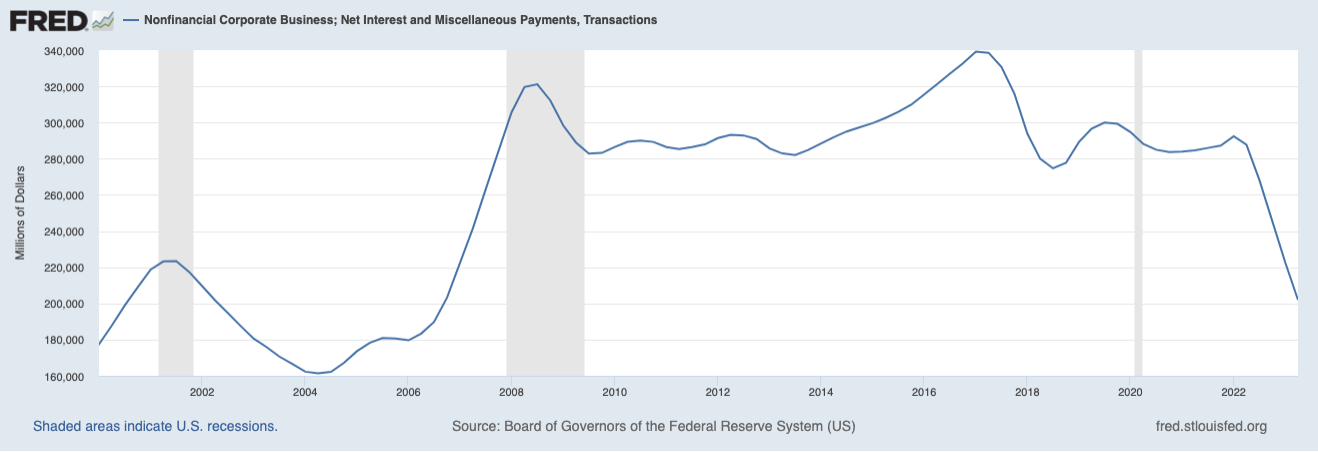

The impact of higher rates on Microsoft’s balance sheet – no change to debt interest payments and higher interest earned on cash – is an outcome we’re seeing across the high-quality spectrum. As seen in the chart below, corporate net interest payments, which is the interest paid on debt minus what’s earned on savings, are falling even as interest rates rise:

For lower quality companies, it’s a different story. These companies also benefited from the era of low interest rates, but they weren’t able to lock in low rates for long periods of time as high-quality companies did. Companies rated as junk, for instance, have very short maturities on their debt (on average), which means they’re now stuck having to refinance that debt at much higher rates in the current environment. Some will go bankrupt.

Bottom Line for Investors

Favoring quality in the fixed-income and equity world seems to be a logical takeaway when focusing on the impact that higher interest rates are having on corporations of various credit qualities. According to research from Société Générale, the interest being paid by the biggest 10% of companies in the S&P 1500 is pretty much still below pre-pandemic levels, even though interest rates have gone up fairly dramatically since then. For the smallest half of companies, however, interest rates paid on debt are the highest in over a decade.

This setup also complicates the Federal Reserve’s efforts to slow the economy. If higher rates for now are making the biggest corporations stronger, it may put them in a better position to invest, grow, and hire. This is the opposite of what the Fed wants right now. That’s where the argument for keeping rates higher for longer comes in, so that eventually the bite of refinancing at higher rates hits top-quality companies.

Most investors can get where they need to go over the long term by owning a diversified portfolio of stocks and/or ETFs. Positioning a portfolio across sector, style, size, and country will almost always provide exposure to the best performing areas of the market while minimizing the impact of the weak performing areas of the market. Volatility gets smoothed out over time, and an investor can earn attractive equity-like annualized returns. It doesn’t have to be more complicated than that, and investors don’t need a huge win in a single stock or IPO or SPAC to get there.

In fact, “diversify your portfolio” is one the most basic pieces of investing advice. Sadly, in our experience many investors still put all (or most) of their eggs in one basket.

At Zacks Advantage, we strive to help every investor properly allocate their assets. In fact, we’ve put together a helpful guide to help you understand the basics of portfolio diversification, including:

- 4 myths of a properly diversified portfolio

- Why the average investor’s returns trail almost every other investment category

- How to create a truly well-diversified portfolio

Get our free guide, Is Your Investment Portfolio Actually Well-Diversified?, 5 to learn how to create a truly diversified portfolio.

© 2023 Zacks Advantage | Privacy Policy | Unsubscribe

1 Fred Economic Data. September 8, 2023.

2 Zacks Investment Management may amend or rescind the Is Your Investment Portfolio Actually Well-Diversified? guide offer for any reason and at Zacks Investment Management’s discretion.

3 Fred Economic Data. October 2, 2023.

4 Fred Economic Data. September 8, 2023.

5 Zacks Investment Management may amend or rescind the Is Your Investment Portfolio Actually Well-Diversified? guide offer for any reason and at Zacks Investment Management’s discretion.

DISCLOSURE

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss.

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research.

Zacks Investment Management, Inc. is a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. Zacks Investment Research is a provider of earnings data and other financial data to institutions and to individuals.

This material is being provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney-client relationship. No recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. It should not be assumed that any investments in securities, companies, sectors or markets identified and described were or will be profitable. All information is current as of the date of herein and is subject to change without notice. Any views or opinions expressed may not reflect those of the firm as a whole.

Any projections, targets, or estimates in this report are forward looking statements and are based on the firm’s research, analysis, and assumptions. Due to rapidly changing market conditions and the complexity of investment decisions, supplemental information and other sources may be required to make informed investment decisions based on your individual investment objectives and suitability specifications. All expressions of opinions are subject to change without notice. Clients should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed in this presentation.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties. Zacks Investment Management does not assume any responsibility for the accuracy or completeness of such information. Further, no third party has assumed responsibility for independently verifying the information contained herein and accordingly no such persons make any representations with respect to the accuracy, completeness or reasonableness of the information provided herein. Unless otherwise indicated, market analysis and conclusions are based upon opinions or assumptions that Zacks Investment Management considers to be reasonable. Any investment inherently involves a high degree of risk, beyond any specific risks discussed herein.

The S&P 500 Index is a well-known, unmanaged index of the prices of 500 large-company common stocks, mainly blue-chip stocks, selected by Standard & Poor’s. The S&P 500 Index assumes reinvestment of dividends but does not reflect advisory fees. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

Robo investments are subject to some unique risks, including, but not limited to, the fact that investment decisions are made by algorithms based on investors’ answers to questions, there is a lack of human involvement, and there is the possibility that the software may not always perform exactly as intended or disclosed. Such investment programs are only suitable for investors who can bear the risk of a complete loss of their investments.

The S&P GSCI is the first major investable commodity index. It is one of the most widely recognized benchmarks that is broad-based and production weighted to represent the global commodity market beta. The index is designed to be investable by including the most liquid commodity futures, and provides diversification with low correlations to other asset classes. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor. An investor cannot invest directly in an index.

The NASDAQ-100 Index includes 100 of the largest domestic and international non-financial companies listed on The NASDAQ Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. Index composition is reviewed on an annual basis in December. An investor cannot invest directly in an index. The volatility of the benchmark may be materially different from the individual performance obtained by a specific investor.

Zacks Investment Management 10 S. Riverside Plaza, Suite 1600 Chicago IL 60606-3830

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. All material in presented on this page is for informational purposes only and no recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Nothing herein constitutes investment, legal, accounting or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.