What you should (and shouldn’t) do in this volatile market

February 15th, 2022 | Posted in Investing, technologyEquity Markets are Volatile – What Investors Should and Shouldn’t Do

The stock market has been edgy in 2022. The year opened with the S&P 500 reaching an all-time high on January 3. But by the opening of trading on January 24, the index was down -12% from the peak – a steep and sudden decline accompanied by worrisome headlines about rising interest rates, inflation, and a potential war in Ukraine (not to mention the ongoing pandemic).

January was a bleak month for equity investors, but we think there is good news in the market’s wobble – the downside volatility looks a lot more like a correction than a bear market.1

Bull markets tend to end with a whimper, not a bang, and a rolling top is generally accompanied by a high level of optimism in the marketplace – neither of which we are seeing today. Corrections are relatively short, sharp, and oftentimes scary declines that are accompanied by worrisome headlines that, while valid, are also widely known. In the current environment, that’s the ‘risk’ of rising interest rates, inflation, and geopolitical flare-ups.

Are Robo Advisors the Right Choice For Investors in Today’s Market?

Robo advisors have made a splash by helping to streamline the investing process and possibly saving investors money. But can they replace the active management and personal attention of a traditional wealth manager? Our free Revolutionize Your Retirement guide takes a look at these important issues and more, providing our insights that may be able to help you make better investing choices. You’ll get our thoughts on:

- The impact of fees on investments

- 4 myths of a diversified portfolio

- Combining Robo technology with active management

Download your copy of Revolutionize Your Retirement2

Corrections also tend to feature pervasively negative sentiment among investors and consumers (check), with a backdrop of solid economic and corporate earnings fundamentals (check). The outlook for economic growth and corporate profits on January 1 was not materially different than they are today, even though the market has been volatile.

During volatile moments like these, investors should first assess whether the market action looks like a correction or a bear market, as we’ve done above, and then take the often-cited fears (we’ll focus on rising interest rates) and consider which is greater: the fear or the risk?

In this case, the analysis is fairly simple. The conviction that rising interest rates will hurt stock returns is more of a theoretical talking point – not an idea supported by data. Over the last 140 years, the correlation between the 10-year U.S. Treasury bond yield and the cyclically adjusted price-earnings ratio for U.S. stocks is -0.21. Meaning, rising interest rates may lead to falling valuations some of the time, but not reliably.

History also shows that rising rate campaigns carried out by the Federal Reserve have rarely coincided with negative stock market returns. Since 1950, the Fed has implemented 13 monetary tightening campaigns, featuring several rate hikes in each. The S&P 500 went up in all but two of them, delivering a median gain of +14% (price return) while the Fed was actively raising rates. Rising rates do not necessarily mean falling stocks – in fact, they rarely do.

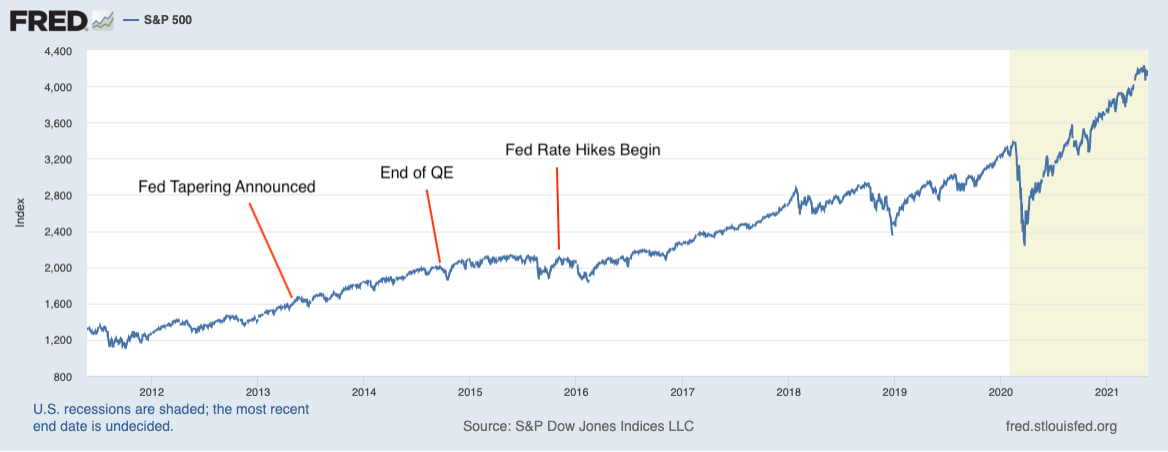

We’ll use the most recent example of Fed tightening as an example. Many readers may remember that the Fed started raising interest rates in December 2015, pushing the fed funds rate from 0.5% in December 2015 up to 2.5% in December 2018. We’re not saying there was no market volatility in the wake of the monetary tightening – there was. But for long-term investors, short-term market volatility should not be much of a factor. Market returns matter over years and decades, not weeks and months. As you can see from the two charts below, Fed tightening caused a few blips and pullbacks during the last bull market, but QE tapers and rate hikes were not powerful enough to prevent the market from pushing higher over time.3

The S&P 500 Over the Last Decade

Source: Federal Reserve Bank of St. Louis4

If an investor is using data, analysis, and historical perspectives to decide what to do in the current environment, we think the conclusion is to remain patient and stick to your long-term plan.

This brings us to what investors shouldn’t do.

Investors should not respond to market volatility by immediately seeking ways to make changes to investment portfolios. When the market takes a sudden and sharp turn, investors often get rattled and start questioning their asset allocation – this is a wrong impulse, in our view.

Getting worried and second-guessing is a normal, natural, and understandable response. Volatility can serve as an opportunity to review your asset allocation and make sure your portfolio is diversified and aligned with your long-term goals. But if you’re feeling the urge to react and ‘do something about it,’ we would put that in the category of what not to do. After all, if your goals have not significantly changed in the past month or during the volatile patch, then in all likelihood your investment portfolio shouldn’t change either.

Bottom Line for Investors

Market corrections happen. Stocks endure choppiness as worrisome headlines swirl about any number of potential risks related to the economic outlook. Over time, however, economic fundamentals tend to overpower short-term fears. In the current environment, if the U.S. economy continues to grow in 2022, while corporations continue to grow profits, and as interest rates go up but potentially not as quickly as many anticipate, then stocks can have a fine year. And we think each of these conditions is present today.

Innovative technology is changing the investment landscape quickly, including making investing for retirement potentially less complicated and more effective. Zacks Advantage is at the forefront of these developments with innovative investment solutions—including retirement investment solutions—using new financial technologies. Our actively managed robo advisor:

- Invests exclusively with ETFs

- Uses technology to recommend the appropriate mix of equities and bond ETFs to help achieve your investing goal and specific risk tolerance

- Lowers fees and expenses

Our free Revolutionize Your Retirementguide5 provides investing insight that can help you determine whether technology-enhanced investing is right for you.

1 Fishers Investments. January 24, 2022. 2 Zacks Investment Management may amend or rescind the Revolutionize Your Retirement guide offer for any reason and at Zacks Investment Management’s discretion. 3 The Balance. January 27, 2022. 4 Fred Economic Data. February 3, 2022. 5 Zacks Investment Management may amend or rescind the A Better Way Forward: Actively Managing Passive Index Funds guide offer for any reason and at Zacks Investment Management’s discretion.

Past performance is no guarantee of future results. Inherent in any investment is the potential for loss

Zacks Advantage is a service offered by Zacks Investment Management, a wholly-owned subsidiary of Zacks Investment Research. Zacks Investment Management is an independent Registered Investment Advisory firm and acts as an investment manager for individuals and institutions. All material in presented on this page is for informational purposes only and no recommendation or advice is being given as to whether any investment or strategy is suitable for a particular investor. Nothing herein constitutes investment, legal, accounting or tax advice. The information contained herein has been obtained from sources believed to be reliable but we do not guarantee accuracy or completeness. Zacks Investment Management, Inc. is not engaged in rendering legal, tax, accounting or other professional services. Publication and distribution of this article is not intended to create, and the information contained herein does not constitute, an attorney- client relationship. Do not act or rely upon the information and advice given in this publication without seeking the services of competent and professional legal, tax, or accounting counsel.